Firm expands value-add investment portfolio in Southern California; brings creative approach and robust experience to transform industrial property into highly functional modern facility

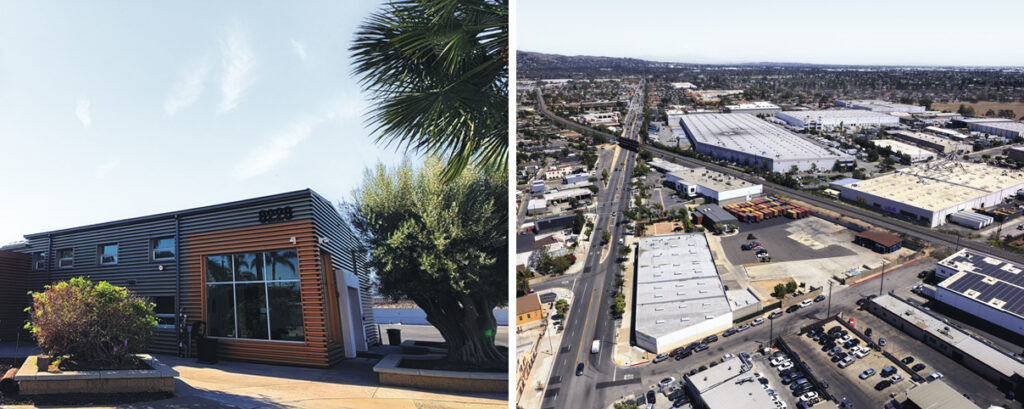

PICO RIVERA, CALIF. – [June 26, 2023] – Leading Western U.S. industrial real estate investor, developer and asset manager, CapRock Partners, today announced its acquisition of Olive Tree Industrial, a 3.1-acre value-add industrial outside storage (IOS) property in Pico Rivera, Calif. Uniquely, this IOS property also includes approximately 31,000 square feet of warehouse space and a large, secured storage yard—a highly desirable feature for tenant-users in this property size range.

The acquisition strengthens CapRock Partners’ foothold in Southern California’s industrial market as the firm actively pursues new opportunities for value-add investment in the Western and Central U.S. CapRock purchased the asset from a private owner. Terms of the deal are not disclosed.

“CapRock Partners is excited to add Olive Tree Industrial to our established portfolio of value-add industrial assets,” said Taylor Arnett, first vice president of acquisitions at CapRock Partners. “With our proven track record and strategic vision, we look forward to unlocking the property’s full potential and creating a functional, efficient space that meets the evolving needs of industrial businesses in the Los Angeles area by catering to both traditional industrial users as well as industrial outside storage users.”

Renovated in 2011, the Olive Tree Industrial warehouse space features three dock-high doors, five grade-level doors, and approximately 5,000 square feet of freestanding creative open offices, and an additional 26,000 square feet of functional warehouse/light manufacturing space.

CapRock will begin capital improvements immediately to reposition the property to enhance its functionality and marketability. The reimagined property will be designed to accommodate a variety of potential users and will be marketed for single tenant use.

“As the supply of existing industrial space in the Los Angeles Basin ages and becomes functionally obsolete in the new era of advanced logistics and distribution, CapRock continues to secure opportunities to strategically reposition underutilized and undervalued assets through our value-add investment platform,” said Mike Kent, senior vice president of asset management at CapRock Partners. “Our team is known for its creative thinking and entrepreneurial approach to industrial real estate investment. Olive Tree Industrial presents an opportunity to leverage our capabilities and deliver a desirable asset for tenants, as well as positive returns for our investors.”

Situated at 8226 Whittier Boulevard, Olive Tree Industrial occupies a prime infill location in Central Los Angeles’ Southland industrial submarket. Convenient to the I-5 and I-605 freeways, it allows for easy access to Downtown Los Angeles, the ports of Los Angeles and Long Beach, regional transportation and the immense local population.

Mark Repstad and Carla Chen with Southland CRE represented CapRock in the purchase transaction and have been retained to market and lease Olive Tree Industrial’s available space.

CapRock is actively acquiring middle market, value-add industrial assets, typically between $20 million and $100 million per acquisition, in addition to land for development opportunities throughout the Western and Central U.S.

In Q2 2023, CapRock broke ground on West Valley Logistics Center, a 12.5-acre site for redevelopment in Pomona, one of California’s strongest and most land-constrained submarkets. Originally a sale-leaseback agreement, CapRock is now underway in delivering a new Class A 270,000-square-foot industrial warehouse on the property. At completion—anticipated in Q4 2024—the complex will feature 40-foot clear heights, 28 dock-high doors, 129 car spaces and 46 trailer stalls.

ABOUT CAPROCK PARTNERS

Founded in 2009 in Newport Beach, Calif., CapRock Partners is a privately owned investor and developer of industrial real estate in the Western and Central United States. With approximately $2.7 billion of assets under management or advisement as of December 31, 2022, the company specializes in acquiring middle-market value-add industrial assets, developing large-scale institutional-quality Class A industrial warehouse facilities in key locations, and providing third-party asset management services for institutional investors. The firm is actively acquiring land for development and middle market value-add assets across the Western and Central U.S. Since inception, its total investment and development pipeline exceeds 30 million square feet of industrial real estate. Follow the company on Facebook, LinkedIn, Twitter and Instagram.